What Does Paul B Insurance Medigap Do?

Wiki Article

An Unbiased View of Paul B Insurance Medigap

Table of ContentsPaul B Insurance Medigap Things To Know Before You Get ThisHow Paul B Insurance Medigap can Save You Time, Stress, and Money.Not known Facts About Paul B Insurance MedigapFascination About Paul B Insurance MedigapPaul B Insurance Medigap Things To Know Before You Get This

Eye health becomes more vital as we age. Eye exams, glasses, and also calls are a component of many Medicare Advantage strategies. Initial Medicare does not cover listening devices, which can be pricey. Several Medicare Benefit plans offer hearing coverage that consists of screening and medically required listening devices. Medicare Benefit intends give you alternatives for keeping a healthy and balanced way of living.Insurance coverage that is bought by a specific for single-person protection or coverage of a household. The individual pays the costs, as opposed to employer-based medical insurance where the employer typically pays a share of the premium. Individuals might buy and acquisition insurance from any kind of plans offered in the person's geographical area.

Individuals as well as households may qualify for monetary assistance to lower the expense of insurance premiums and also out-of-pocket costs, but just when registering with Connect for Health And Wellness Colorado. If you experience specific changes in your life,, you are eligible for a 60-day period of time where you can register in an individual strategy, also if it is beyond the annual open enrollment period of Nov.

15. Link for Health And Wellness Colorado has a complete list of these Qualifying Life Occasions. Dependent kids that are under age 26 are qualified to be consisted of as household members under a parent's insurance coverage.

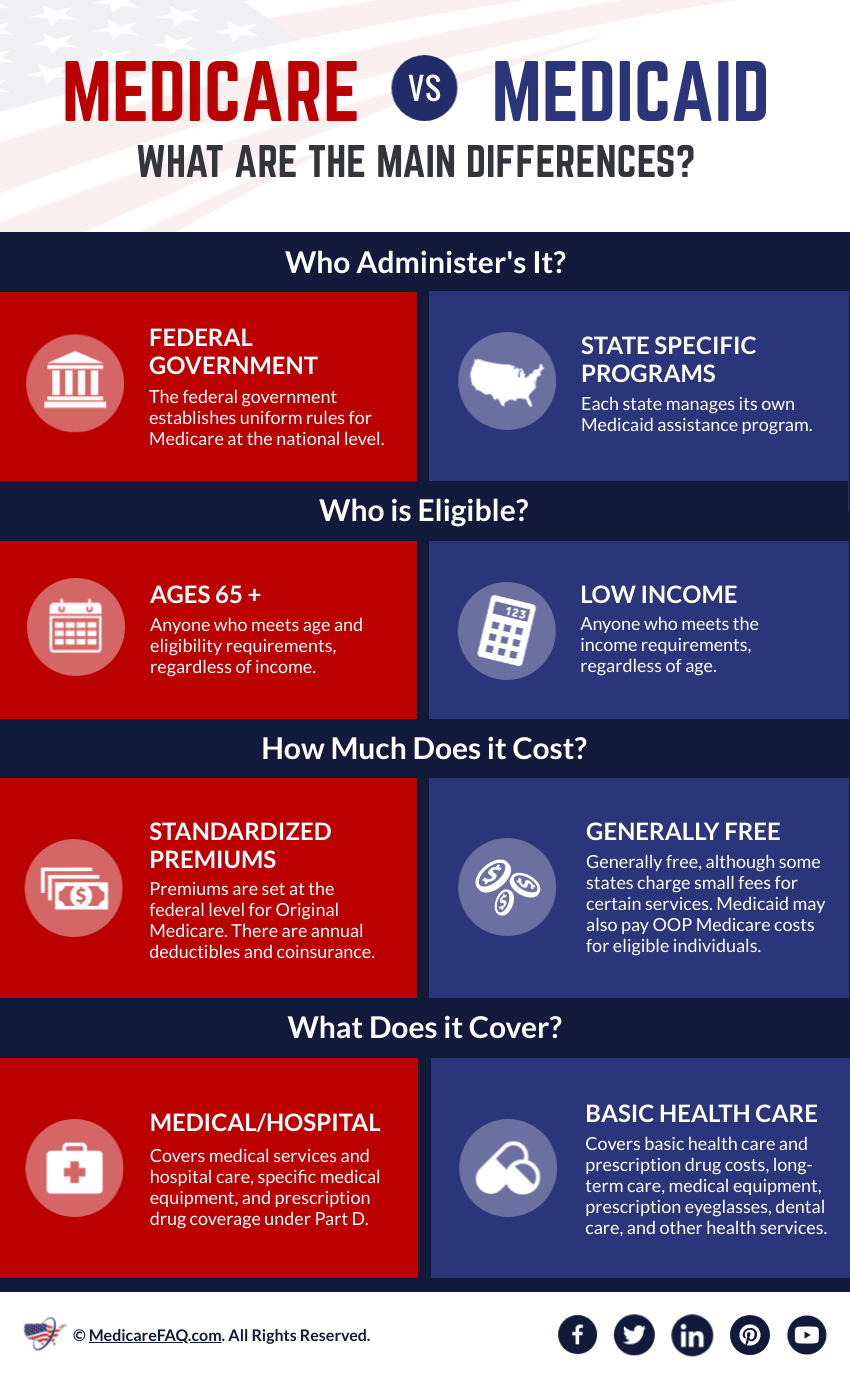

There are lots of medical insurance alternatives on the marketplace, consisting of both government-funded as well as exclusive options. Anyone age 65 or older certifies for Medicare, which is a government program that supplies economical medical care coverage. Some individuals might prefer to contrast this protection with exclusive insurance options. There are some considerable distinctions in between Medicare and also private insurance policy strategy options, insurance coverage, prices, and also extra.

, as well as various other health benefits.

The distinctions between Medicare and also private insurance coverage are a substantial aspect in determining what type of plan may function best for you. When you sign up in Medicare, there are 2 main parts that comprise your insurance coverage: There are numerous options for buying private insurance policy. Lots of people purchase private insurance through their employer, as well as their employer pays a section of the premiums for this insurance as an advantage.

The Paul B Insurance Medigap PDFs

There are 4 tiers of personal insurance strategies within the insurance policy exchange markets. These rates differ based on the percent of solutions you are in charge of paying. cover 60 percent of your health care prices. Bronze plans have the greatest insurance deductible of all the plans however the most affordable month-to-month premium. cover 70 percent of your health care costs.

cover check my source 80 percent of your healthcare expenses. Gold plans have a much reduced insurance deductible than bronze or silver strategies however with a high month-to-month premium. cover 90 percent of your healthcare prices. Platinum plans have the most affordable insurance deductible, so your insurance coverage often pays out really swiftly, however they have the highest month-to-month costs.

Additionally, some personal insurance policy business additionally sell Medicare in the kinds of Medicare Advantage, Part D, and also Medigap strategies. The coverage you get when you register for Medicare depends on what type of strategy you pick. The majority of people select one of two choices to cover all their medical care needs: initial Medicare with Part D and also Medigap.

If you need added insurance coverage under your strategy, you need to pick one that uses all-in-one coverage or add extra insurance plans. You may have a plan that covers your healthcare services however needs extra strategies for oral, vision, and life insurance policy benefits. Nearly all health and wellness insurance plans, exclusive or otherwise, have costs such a premium, deductible, copayments, and coinsurance.

Fascination About Paul B Insurance Medigap

There are a variety of expenses related to Medicare protection, depending on what type of strategy you choose. Right here is a take a look at the expenses you'll see with Medicare in 2021: Many people are eligible for premium-free Component An insurance coverage. If you haven't functioned an overall of 40 quarters (one decade) during your life, the regular monthly premium arrays from $259 to $471.The everyday coinsurance costs for inpatient care variety from $185. 50 to $742. The regular monthly costs for Component B starts at $148. 50, as well as can be much more based upon your income. The deductible is $203 for the year. Coinsurance is 20 percent of the Medicare-approved price for solutions after the insurance deductible has actually been paid.

These amounts vary learn this here now based upon the plan you pick. In enhancement to spending for parts An and also B, Component D costs vary depending upon what type of drug coverage you require, which medicines you're taking, and also what your premium and deductible quantities include. The monthly and also annual expense for Medigap will certainly rely on what kind of strategy you choose.

The most a Medicare Benefit plan can charge in out-of-pocket prices is $7,550 in 2021. paul b insurance medigap. Original Medicare (parts An and B) does not have an out-of-pocket max, suggesting that your medical expenses can promptly include up. Below is a summary of several of the conventional insurance expenses as well as just how they collaborate with regard to private insurance: A premium is the regular monthly expense of your medical insurance plan.

The 7-Minute Rule for Paul B Insurance Medigap

Coinsurance is a percentage of the total authorized cost of a service that you are in charge of paying after you've fulfilled your deductible. All of these costs depend upon the sort of exclusive insurance coverage strategy you pick. Analyze your financial situation to determine what kind of regular monthly as well as annual repayments you can pay for.

Report this wiki page